The #1 BEST Way to Organize Your Bills

Organizing expenses can be a time-consuming and painful task. Luckily for you, I’ve got a few tips to help you organize your monthly and annual bills.

We’ll start by discussing why organizing your bills is important, when and where to organize them, which bills to organize, and how to BEST organize them.

Some links in this post are affiliate links that may help me earn a small commission at no extra cost to you.

Why organize your bills?

Organization as a concept has been used for centuries. It’s easy to assess why you should organize your bills if you’re living paycheck to paycheck, but if not, why would you need to organize? My simple answer to this is checks and balances. In business it’s common practice for each expense to be checked for accuracy and relevance.

So, why would you treat your life any different? Don’t you want to know every expense that’s affecting your cash flow, while also not overwhelming yourself by checking every single transaction? Yes? Good. You’ve come to the right place! Using my organization method will enable you to not have to check every single transaction.

When to organize? Am I too late?

Good news – you can organize your expenses/bills ANYTIME. It’s never too late, or too early, to start tracking what money is being taken from you, when it’s being deducted, and why.

Starting early is a huge benefit to you, because you can continue to add expenses as they come, instead of backtracking. However, the benefit to back-tracking your expenses is accurate tracking. more on that in the “How” section.

If you prefer tracking your bills physically, you can get this Bill Tracker off of Amazon!

Where to organize them?

Now, there’s not one single best place to organize your bills. Instead, you need to choose what works best for you. Some of my suggestions would be; iPhone notes, Google Sheets (what I use), Excel, Google Docs.

In order to find which platform is best for you, ask yourself: Where do I track other things in my life? Are they on paper? In the Notes app of my phone? Or in a Drive somewhere?

Another deciding factor of which platform to use is if you’re sharing this document. Do you have a financial coach that may want access? Or a partner? If so, make sure that you choose a live platform that each of you can update in real-time.

I, personally, use Google Sheets. The document is shared with my Husband, and we track his expenses in the same place. I also appreciate the customizability (is that a word?) in Sheets. If I want to add a new column for which card the expense is charged to, it’s as easy as a click of a few buttons! Before that, I used the Notes app on my iPhone. This worked for the first 3-4 years of tracking my expenses, but I quickly learned I wanted to see my bills in a more visually-pleasing way, so I switched to using a table on Google Sheets.

Which bills should I organize?

The simple answer is, all of them! That’s right, from the $0.01 monthly charge (not sure what this would be but…) to your $500-ish spent on holiday gifts each year.

Types of Bills to Track

Consistent Monthly

An expense that is consistently charged monthly may be your mortgage, phone bill, insurance, HOA, gas, electricity, media subscriptions, car wash, and more. This is any charge that will continue to be charged monthly at the same cost. The only adjustment to this cost would need to be given with notice to you, for example when Xfinity sends you that very unfortunate email that your rates have increased (knock on wood).

This type of bill should be fairly easy to track, because you have an email notifying you of the charge and/or you can check previous charges to see the consistent amount that is charged.

Consistent Annual

A Consistent Annual charge is similar to a consistent monthly charge in that it will continue to be charged at the same cost, but instead at an annual timeframe. A good example of this may be an annual charge to a fitness gym.

It’s important to track these annual charges because right now you may have the money to make the charge, but 1 year is a very long ways away. You never know what may change with your financial situation, and it’s better to plan ahead.

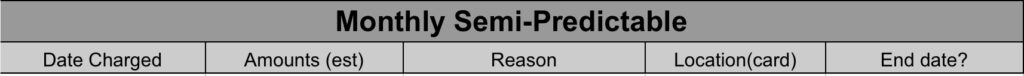

Monthly Semi-Predictable

Monthly Semi-Predictable charges are things like food, gas, and entertainment. You don’t spend an exact $50.27 when you eat out each month, that cost may vary each month. However, for gas in particular, you may make a similar commute each month and be able to figure that you spend an average of $300 a month (I know, I know, I have a Jeep…) to go off of.

Annual Semi-Predictable

Similar to Monthly Semi-Predictable expenses, Annual Semi-Predictable expenses are costs that may vary slightly each year, but you want to make sure to plan ahead for them. A good example of this is money spent on gifts around the holidays. You can’t put an exact number on it (I mean, toys are getting more and more expensive each year!), but you can guesstimate (one of my favorite words) what you may spend on holiday gifts so you can plan ahead.

A great example that I used Annual Semi-Predictable expenses for was my contacts. I used daily contacts (terribly expensive, thankfully I’ve made the switch) that costed about $1,000 a year. Now, I’m not the type that can just whip out $1,000 and call it a day. For that kind of expense, I need to plan a few months in advance. Thankfully, I had tracked my expense ahead of time so by the next year I was able to get my contacts in time and not have to use my glasses – which I very-much-so dislike. Anyways, that’s off topic…

Like saving hard-cash? Try out this Money Saving Budget Binder

Now, time for the HOW

Now that you’re familiar with the different types of expenses to track, how to get that process started? Let’s cycle back to that platform that you decided to use for your tracking. Let’s stick with Google Sheets, and if you have questions for tracking on other platforms you can leave your questions in the comments below.

Within Google Sheets, create a new sheet and name it whatever you want. This should stand out so that you remember how to refer back to it at any time. Start your organization with a table with headings that look like this:

Title the type of expense at the top, then the above columns. Here’s what they mean:

- Date Charged = Which date of the month you can expect the charge to be made

- Notice that sometimes, when banks are involved especially, you may receive payment on varying dates, but it’s always the second Monday of the month. In that case, you would put “Second Monday” in this cell

- Amount (est) = The amount that is charged. In the Semi-Predictable types of expenses I put “(est)” next to the Amount since this amount is an estimate

- Reason = What the expense is for. I keep this short; gas, entertainment, EOS Membership, etc.

- Location (card) = This is where you can expect the charge to come out of. I am pretty centralized to one card for all expenses, but I know some individuals like to (or need to) keep charges coming from multiple bank accounts or credit/debit cards

- End Date? = The last date this expense will be charged. Not every expense will have an end date, but for example mortgage payments and car payments should have an end date, and it can be hopeful and helpful to keep this end date top of mind

After you’ve created a similar heading format, you can start to add each individual expense. I’ve created a guide for each type of expense below:

Consistent Monthly

Remember, these are bills that are charged at the same rate, at generally the same day each month. Check through your previous charges on each account, and any that repeat monthly should be added to this list.

Consistent Annual

These are similar to Consistent Monthly charges, but are instead charged consistently each year. If you haven’t already been tracking your consistent annual charges this may be difficult, but you’ll want to check through your past year of charges and try to remember if this is an annual charge that will be repeated.

Another option, and preferred by some, is to add expenses to this list in the FUTURE. At the end of each day, check your expenses & add any recurring charges to this list. In order to catch all annual expenses you would need to do this each day for an entire year, whereas you’d only have to check each day for a month to catch the Consistent Monthly expenses.

Monthly Semi-Predictable

In order to guesstimate your monthly spend on things like gas, entertainment, and food you will want to check through your previous months of charges. Some bank apps have a user-friendly version to check this. For example, Chase Bank has a feature that shows you how much you’ve spent on food in the past month, and will even give you an average for the past few months.

If you don’t have a fancy feature like this in your bank’s app, you can throw a guesstimate (I love that word, can you tell?) number in and each month check yourself for accuracy.

Want to help your kids, or yourself, save? Try out this ADORABLE Piggy Bank

Annual Semi-Predictable

To guess your upcoming Annual Semi-Predictable expenses, the best idea I can propose to you is to think. Ask yourself, what is something I pay for each year? Think through each season, each child, each sports event, and ask that question. For me, I know I pay for my contacts, Christmas gifts, and cheap flights-finder app (Flights from Home) annually.

Now that you’ve added all of your expenses, total them up (in Google Sheets you can type = Sum (First Cell:Last Cell) ) to find your monthly and annual expenses. Now, you can plan ahead for expenses that are coming your way and be more on top of your finances for the future!