Whether you’re looking to grow financially, or get a grasp on your current income, tracking your finances can be an empowering tool to take ahold of something that runs many aspects of our society; money. It’s how we live, eat, and, in some cases, breathe. Therefore, ensuring your incoming cash flow is able to maintain the lifestyle you need or want to live is imperative.

Some links in this post are affiliate links that may help me earn a small commission at no extra cost to you.

Why Tracking Your Income Will Benefit You

“So, Paige, why would I need to track my income? Isn’t checking my paystub enough?” Great question! There’s a few crucial reasons I’d like to share in hopes to convince you to start tracking your income.

Payroll Errors

Remember, if you’re working for a company as of 2024, it’s being run by humans who make errors. Despite automation and the growing use of robots in businesses, payroll errors are a very real issue. It’s happened multiple times to me, personally, where I’ve seen an error in my paystub and thank goodness I caught it or else I may have never been paid what I was owed. It’s helpful to remember that most companies do not make payroll errors on purpose. But an even more comforting feeling is knowing you, personally, can calculate what you should be receiving each paycheck for consistency.

Recognizes Personal Financial Growth

After years of tracking your income, you’ll hopefully be pleasantly surprised by your growth. Or, on the contrary, you may come to the realization that it’s time to request a raise from your employer. Either way, being aware of your own personal income trend will bring to light your wins, or your needs for improvement.

Goal-Setting

Once you’ve recognized your income trend throughout your employment history, you can set financial goals for the future. Maybe you want to request a raise to help you buy a home, or afford that dream-card you’ve always been pinning for. Either way, it’s hard to set a goal if you don’t already recognize where you’re at.

Compare Income to Expenses

You’ve found trends in your past income, set goals for the future, but what about reality? You know, mortgage, insurance, car payments, etc? Well, tracking your income along with your expenses, see my post on #1 BEST Way to Organize Your Bills, will allow you to know your Net Profit. Your Net Profit, aka “Net,” is the total amount of cash you have left after you subtract Total Expenses from Gross Income. Knowing your Net tells you what you can spend on fun, entertainment, treats, fashion, or other things in life that are “wants” and not “needs.”

When to Start Tracking Your Income

Now that I’ve convinced you to track your income, is it too late or too early to start? Nope! You can start tracking your income at any time, at any age. Earlier is better, but it’s never too late. “But when do I have the time to track all this?” With my method, you can start tracking while waiting at the doctor’s office, in the restroom, or even on a road trip! The first step is making the leap to take hold of your finances, and from there all you can do is go up!

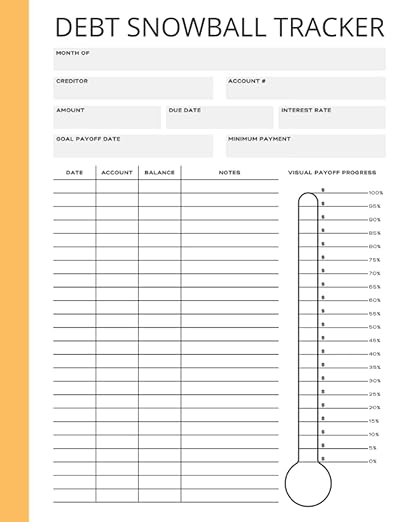

If you are feeling behind the curb and need to work through debt, try using Amazon’s Debt Snowball Tracker

Where’s the Best Place to Track my Income?

What you’ve been waiting for, where’s the best place to track my income? I’ll share with you the three methods I tried, why I liked them, disliked them, and why I eventually chose to stick with option #3: Google Sheets.

Option #1: Good Ol’ Paper – Soup is too cold

Now, nothing against paper lovers, but I just can’t stand having to carry more than I have to. And I’m not talking in a figurative sense, I actually have neck issues! So, carrying around books and books of the things I track from income, expenses, shopping lists, bucket lists… this list… becomes way too tiresome. Instead, I aim to track any and everything from my mobile devices that stick with me everywhere I go. So, I could go from the grocery store to checking flight destinations without ever having to run home to grab a list.

Want to stick with paper? That’s ok! Try out this super cheap Budget Planner from Amazon!

Option #2: iPhone Notes App – Soup is too hot

Now, the notes app on your smart phone is a step in the right direction, but this still wasn’t enough for me. On iPhone notes app, there’s no filtering or equation abilities. Meaning, I couldn’t filter out expenses only or sum my entire list of income earned in one year. Another issue I’ve ran into with my Notes App is its collaborative ability. I’ve noticed improvement in recent years, but back when I added my husband into my finances sharing that note with him made the app glitchy and slow. And for those that know me, patience is not my strong suit.

Option #3: Google Sheets – Soup is just right!

After exhausting the two methods above, I finally discovered Google Sheets. Well, I knew of Sheets, but didn’t understand the capabilities of it in regards to finances. I can create complex equations, averaging out my commission and bonus earnings since the beginning of the year without pulling out a calculator. It’s got color-coding capabilities, infinite cells (as far as I’m aware of), and so much more.

So, if you’ve got a GMail account, let’s get moving on to the next step. However, if you prefer to use Excel you are completely welcome to, just know that the verbiage I’ll be using will need to be translated to Windows capabilities.

Tracking income and expenses with your partner? Check out this Budget Planner for Couples. Not to mention, you can also read “Smart Couples Finish Rich.”

How To Track Your Income

You’ve signed into GMail, opened your Google Drive, and created a blank Sheet. Now, it’s time for the fun part!

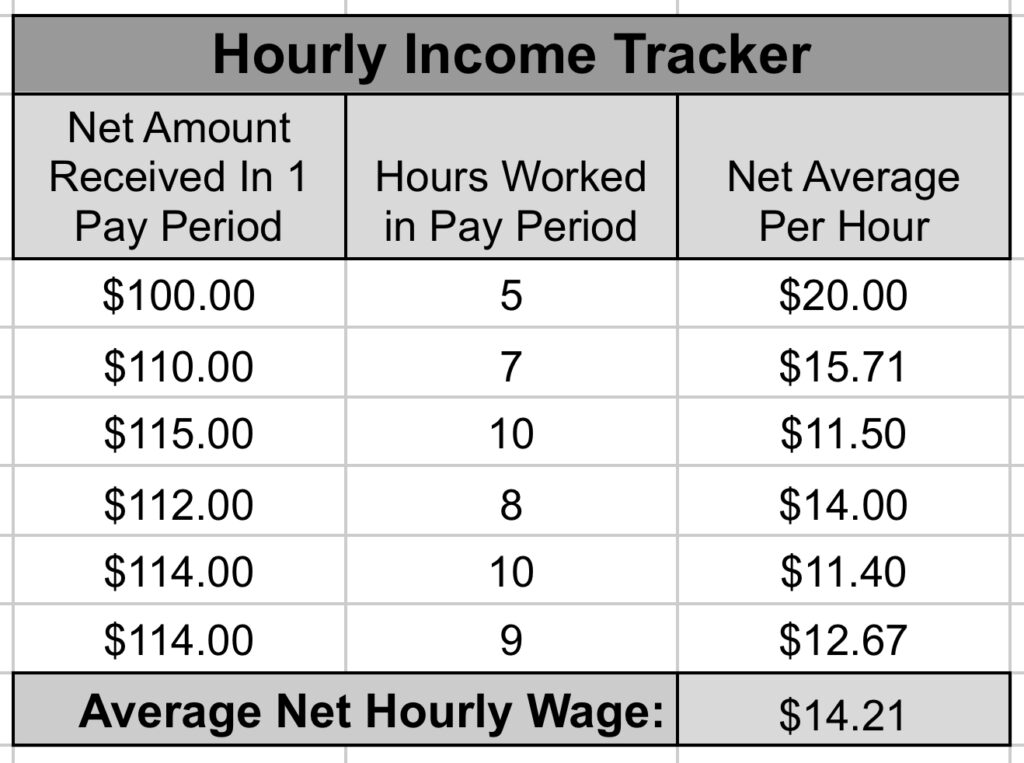

Tracking Income for Hourly Wages

If you work an hourly paid position, you’ll want to start by calculating how much you make per hour after taxes. You’ll find this by checking the net amount received on your paystub or in your bank, and divide that number by the amount hours you worked during that pay period.

Net Payment Received / Hours Worked Within that Pay Period = Net Hourly Wage

Remember that taxes are not generally withheld at an exact amount. So, you will want to remember that this amount can vary slightly each week. My suggestion would be to track this Net Hourly Wage amount for 3-4 paychecks to see how variable your Net is. Then, when planning ahead on your income, use the lowest number. The reason I use the lowest number is that anytime you are dealing with finances, you want to plan for the worst case scenario. If you plan for best case scenario, but end up earning the lower amount, you will feel the affects of not properly planning ahead.

Within your spreadsheet, it may look like this:

Now, you can multiply this Net Hourly Wage by the amount of hours you generally work in a month (which you can also track on this spreadsheet) to find your general monthly earnings. You can do the same for annual, weekly, etc.

Tracking Income for Salary Wages

Tracking Salaried income is generally easier than hourly, especially if you seldom take time off without PTO available, since that negatively affects your income. Each pay period, notate the Net amount you received. When planning ahead for savings goals or large expenses, you can base your expected income off of either the lowest amount or average.

The reason I say salaried individuals can base their income off of the average instead of the lowest earned amount is that a wage based off of salary is generally more consistent than wages based off of an hourly wage.

Tracking Income for Salary + Commission & Bonus Wages

Commission and bonus’ included in one’s wage can also pose an obstacle when calculating income, but it’s not impossible. The way you document your income in your spreadsheet will depend on how frequently you get paid. For example, if you get paid once a month including your base salary, commission, and bonus’, you can track your salary the exact same as above. The only change I’d make is basing your future goals and plans on a lower amount, since commissions and bonus’ can vary quite a bit.

However, if you’re paid twice or more a month, you’ll want to separately track your payments. One based on base salary, and another based on your commission, bonus, and potential base salary earnings (if they’re all grouped together on one of your paychecks and not the other). This way, you can see the wage you can steadily plan for (base salary Net amount) and the wage you know may give you a “bump” here and there (commission, bonus). Again, if you’re making future plans or are preparing for a financial adjustment, you’ll want to plan based on your lowest commission and bonus earnings in the past 12-24 months.

I’ve Tracked My Income, Now What?

The world is your oyster! (I’ve really never understood that phrase, oysters are quite small….) Find trends in your income, set goals for the future, and work closer and closer to becoming financially free!

Create good habits with the Habits Tracker in this SUPER CUTE 52 Week Planner off of Amazon